OP-Ed Impact of Military Aggression on Children

February 28, 2009

How does Military Action Impact Young Minds?

A teenager’s viewpoint regarding article by New York Times —

http://www.nytimes.com/2009/02/18/world/asia/18afghan.html,

http://www.nytimes.com/slideshow/2009/02/17/world/20090217AFGHAN_9.html

And concerns about real victims of war i.e. children.

The article that goes along with this picture talks about how the death toll in Afghanistan has risen by over forty percent in 2008. One specific example reported on a man named Syed Mohammed, who’s entire family was slaughtered by American and Afghan soldiers. He went next door to his son’s house, only to find that the only survivor in his entire son’s family was his four year-old grandson, Zarqawi. In another case, an American AC-130 gunship, which is a plane armed with several deadly explosive rounds as well as a gatling cannon, attacked a suspected Taliban building, killing more than 90 people. Mohammed Amin Kadimi, age 47, was pushing a wheelbarrow through a city street, looking for work.

Marai, age 7, was blinded in one eye from shrapnel during fighting between the Taliban and NATO troops.

Photo: Lynsey Addario for The New York Times

A young man approached him carrying a paper bag weighing about ten pounds. He asked him to carry the bag to Pul-e-Khesti, a nearby neighborhood. After some time walking, Mr. Kadimi noticed that the young man was no longer behind him. The bag then exploded, blasting Mr. Kadimi away, mangling his right leg and severing his left one. He now sits on a city street, selling phone cards. He wonders why he was chosen as a target.

When I assess these so-called carnage reports, I am absolutely disgusted. It is appalling that human kind would resort to such violence against one another, and for no valid cause at all. Exemplified in the cases of Marai and Youssif, the boy who’s face was grotesquely deformed by shrapnel from a fragmentation grenade; even children on the cusp of life are subject to such tortures as these. The brutality towards these innocent civilians is inexplicably revolting and inexcusable. No ‘political’ motive should be so great as to put the lives of innocent people at risk.

Youssif, age 5, before explosion (left), and after explosion (right)

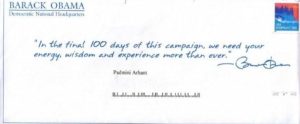

Presidential Communication

February 26, 2009

From: President Barack Obama

To: Padmini Arhant

Sent: Wednesday, February 25, 2009 1:14:20 PM

Subject: My address to Congress

| Padmini —

Last night, I addressed a joint session of Congress for the first time. To confront the serious economic challenges our nation faces, I called for a new era of responsibility and cooperation. We need to look beyond short term political calculations and make vital investments in health care, energy, and education that will make America stronger and more prosperous well into the future. Watch a few highlights from my address and share it with your friends now: A little more than a month into my administration, we’ve already taken bold steps to address our urgent economic problems. Through the Recovery Act, the Stability Plan, and the Housing Plan, we’re taking the immediate necessary measures to halt our economic downturn and provide much-needed assistance to working people and their families. But to set our country on a new course of stability and prosperity, we must reject the old ways of doing business in Washington. We can no longer tolerate fiscal deficits and runaway spending while deferring the consequences to future generations. That’s why I pledged last night to cut our deficit in half by the end of my term. Achieving that goal will require making sacrifices and hard decisions, as well as an honest budgeting process that is straight with taxpayers about where their dollars are going. Watch some key moments from my address now: http://my.barackobama.com/presidentialaddress Central to this plan will be a renewed commitment to honesty and transparency in government. Restoring our country’s economic health will only happen when ordinary citizens are given the opportunity to hold their representatives fully accountable for the decisions they make. I look forward to continuing to work with you as we bring about the change you made possible. Thank you, President Barack Obama —————————————————————————————————————————– Response to Communication: From: Padmini Arhant To: President Barack Obama Sent: Thursday, February 26, 2009 11:00:27 AM Subject: Re: My address to Congress Dear Mr. President, Your address to Congress and American taxpayers was impressive and right on target. However, any commitments towards short-term goals and long-term vision are authentic and acceptable with less skepticism when backed by specifics. I’m sure your administration will forward necessary details in the near future. As for my continuing contribution to your administration; With all due respect, to you and the office of Presidency, I request clarifications regarding your expectations from me. It would be immensely helpful if you could please define my role and make it official to enable me in providing you unwavering support and service throughout your Presidency and beyond. I hope you understand my predicament. Look forward to your response in this regard. As your vehement supporter, I wish you nothing less than phenomenal success in all your endeavors. Thank you. Best Wishes Padmini Arhant |

California Budget Deficiency

February 20, 2009

At last, after a prolonged melodramatic stunt by lawmakers the California state budget concluded as a major achievement!

The review of the proposed budget appears to be nothing but analogous to a dish prepared for starved patrons by reluctant chefs deliberately ignoring the recipe provided to them while using the ingredients to serve themselves their own favorite dish.

Does this come as a surprise?

Not in this era of special interests and politicians cozying with one another on the maxim “You scratch my back and I’ll scratch yours.”

The worst victims of this fundamental fiscal policy are the children and students, the future taxpayers of this economy.

Does this bother any of those advocates involved in merciless slashing of funds to K-12 and college education?

If it did, they would not have propagated such ideology and as for those to allow this to happen simply suggests their complicity to this charade.

Perhaps, the concerned policymakers could not arrive at a decision to balance the budget up until twenty-four hours ago because they were too busy devising a plan to keep them in power and protecting their own families with children attending private schools or schools not hit by severe funding cuts.

What about them targeting social welfare programs affecting the elderly, sick, disabled, unemployed, veterans and other dependents?

Should we assume the lawmakers could not relate to this segment of the population because fortunately for them they do not have or know anyone in vulnerable position, hence the end justifies the means.

The defenders of the disproportionate funding to the criminal justice system in the budget safeguard their interests at the expense of kids kicked off the welfare and students struggling to meet college expense with some winding up in the overcrowded prison system thus making the so-called reformers’ jobs secure.

That’s why these beneficiaries of dysfunctional democracies display their titles and flex muscles to quell dissent by alienating citizens of diverse background during any crisis.

They conveniently forget the fact that people of ethnic origin are also part of the society making significant contributions in every aspect particularly as taxpayers and their role is not limited to being the benefactors and lately campaign donors as well as volunteers during elections and beyond.

Ironically, legislators have successfully defended corporations by granting them generous leeway as they realize that corporations’ profit will serve the lawmakers during election campaign through donations and ordinary citizens whose votes ultimately grant them power are left to fend for themselves in the tough economic times.

As stated earlier on several occasions, the democratic system essentially run by corporations and the power brokers at the state and federal level prioritizing self- interest over national interest and the electorate forced to be accustomed to this general trend.

Who are the real beneficiaries in this budget?

It is certainly not the disadvantaged and bereft population in requirement of present government assistance to enable them to be future providers of the economy. The other interesting factor in both state and federal dramatic unfolding of legislative approvals is spot the lame duck in this game.

During the captivating rule of the previous administration, the former President George W. Bush mischaracterized as the lame duck, though the majority Democrats would have appropriately fit the profile due to unprecedented use of vetoes exercised by the then Chief Executive at the White House on most issues regarded detrimental to the subjects of the kingdom.

One would assume that gaining majority rule in both houses and the executive branch at both state and federal government is a guaranteed victory in legislative matters. It remains a wishful thinking for one while the other regardless of status quo prevails in failed ideology against pragmatism.

Therefore, the lame duck in the game is none other than the electorate at the bottom of the socio-economic scale and the weak representatives lacking courage to fight for the cause and the purpose of their election to power in a democracy.

In essence, ballots cast by ordinary citizens elevate individuals to power and these elected officials preoccupy in strengthening their own position in office with political bargains even if similar measures overrides the promises on the campaign trail.

Either way, the victims are invariably the electorate granting authority to ambitious political minds often negotiating constituent’s future for personal gains.

Is there a hope to break the chain link for ordinary citizens in a democracy?

“Impossible is written in fool’s dictionary." In any active democracy, the people possess power to ensure fulfillment of electoral commitments by political leaders favoring the electorate and not any special interests or themselves.

Unfortunately, in this budget decision the stalemate was unnecessary as it was with the passing of the federal economic stimulus package. Whenever a minority poses a threat to majority on genuine solutions to problems created by failed policies, it is red alert for electorate to eliminate blockades through elections confirming the power and strength of democracy.

How does the budget impact the ordinary electorate living paycheck to paycheck and families dependent on social programs and public school education?

With deep cuts in education including hikes in college tuition fees and social programs, the average Californians penalized with tax increase via sales tax, vehicle license fee and reduction of dependent benefits from $300 to $100.

The thoughtful policymakers in return decided to redirect the hard fought funding to Corporations via undue credits and maintenance of horse race grounds over education and other essential social services.

Diversion of spending cuts from future taxpayers to benefit self serving interest groups definitely speaks volume on priorities by fiscal conservatives.

Not all those vehemently opposed to socialism are entirely objectionable to redistribution of wealth as long as the recipients are their own kind focused on wealth amassment at the expense of struggling majority.

In fact, voter rejection of two-thirds majority approval in state and federal legislative matters will permanently remove gridlocks in a democratic process besides successfully replacing any need for Open Primaries in the state elections.

It is time for the worst affected groups in the current budget proposal to coalesce and act decisively against willful negligence of issues ranging from education, social programs, environment, and energy… by elected representatives especially with options available to balance the budget.

We sure have a budget to justify the role of government despite the huge deficiency and failure to address the needs of the distressed population.

Democracy best served when the governments of the people run by the people and for the people.

Thank you.

Padmini Arhant

OP-Ed Impact of Military Arsenal on Children

February 19, 2009

From: Kanish

How does the war impact young minds?

A teenager’s viewpoint regarding an article by New York Times and concerns about the real victims of war – Children, the future of the world.

Source: http://www.nytimes.com/2009/02/18/world/asia/18afghan.html

http://www.nytimes.com/slideshow/2009/02/17/world/20090217AFGHAN_9.html

———————————————————————————

The article that goes along with this picture talks about how the death toll in Afghanistan has risen by over forty percent in 2008.

One specific example reported on a man named Syed Mohammed, who’s entire family was slaughtered by American and Afghan soldiers. He went next door to his son’s house, only to find that the only survivor in his entire son’s family was his four year-old grandson, Zarqawi.

In another case, an American AC-130 gunship, which is a plane armed with several deadly explosive rounds as well as a gatling cannon, attacked a suspected Taliban building, killing more than 90 people. Mohammed Amin Kadimi, age 47, was pushing a wheelbarrow through a city street, looking for work.

A young man approached him carrying a paper bag weighing about ten pounds. He asked him to carry the bag to Pul-e-Khesti, a nearby neighborhood. After some time walking, Mr. Kadimi noticed that the young man was no longer behind him. The bag then exploded, blasting Mr. Kadimi away, mangling his right leg and severing his left one. He now sits on a city street, selling phone cards. He wonders why he was chosen as a target.

Marai, age 7, was blinded in one eye from shrapnel during fighting between the Taliban and NATO troops.

Balancing California Budget

February 12, 2009

The golden state is in deep economic crisis, sharing the status quo of the nation.

As per Wikipedia.org – California would have the 7th highest GDP in the world if thought of as a country (not including the US as a whole, if so, it would be 8th).

A great state like California being the epicenter for – besides earthquakes,

Technology

Biotech and stem cell research

Entertainment symbolized by Hollywood

Diverse talent and skill pool making outstanding contributions in various fields.

Yet, the fundamental responsibility of the state government to balance the budget postponed indefinitely due to partisan politics with Republican minority misusing the two-third majority approval against the incumbent Democrats in the legislature.

As a result, the taxpayers of the economy are abandoned and the entire population is at the mercy of the minority rule upholding the conventional ideology against contemporary wisdom.

It is Déjà Vu for those following the federal government struggle to get the economic stimulus bill approved by both Houses of Congress.

The dilemma of balancing the budget with the political parties’ resistance to compromise is a daunting task for any administration. It is beyond comprehension that failed policies and inconvenient principles continue to dominate the center stage at both state and federal level in legislative matters.

California budget deficit currently at $42 billion with unemployment skyrocketing to 9.3% and expected to worsen by the year-end;

Clearly, the economic recession is widespread and taken severe toll on the present and future taxpayers of the economy.

———————————————————————————————————————

Challenges:

How does the state reduce the budget deficit of $42 billion?

Generally, the options would be exploring ways to generate revenues and cutting costs proven liabilities with no income or other benefits to the taxpayers of the economy.

Revenues:

How does the state generate revenues?

Usually, the government revenue sources are taxes paid by individuals and Corporations.

They are in the form of income tax, estate tax, corporate tax, payroll tax, sales tax, customs and excise duty on export and import items as well as fees and charges for any government provided services. If the state has other assets in the form of government bonds and treasury bills, they comprise negotiable instruments to borrow money.

In addition, the government could potentially expect income from investments in industries via quasi contracts, state run institutions, sale and/or leasing of government land to private sectors and trade goods and services with neighboring states or foreign governments. Some states find ways and means to share natural resources with their neighbors within and outside the nation for income.

Then, a federal aid to boost social services, health and educational programs is other channel for financial assistance.

Obviously tax increases is the common strategy for meeting budget shortfall. If income and aid are available from stated sources, then funding expenses is affordable.

——————————————————————————————————————-

Spending or Costs Elimination:

In this category, the lawmakers vehemently opposed to tax increases propose massive cutbacks and reduction in spending by a sweeping shutdown of essential services and programs with dire consequences in the long term.

Ironically, investment in education, health, housing, energy and environment are easy targets as “wasteful spending” for legislators in opposition to tax hikes during budget crisis. Those policy makers fail to understand the importance of protecting and nurturing the beneficiaries of these programs as they contribute to the economy today and tomorrow as taxpayers.

Lately, legislators have taken a swipe at education or investment in public school systems at both state and federal levels. It is tragic that such measures are even contemplated leave alone legislated in the industrialized and advanced nation that should be leading the world in K-12 educational program.

The public school system in the State of California and across the nation is in shambles. The infrastructure and the general classroom environment are in desperate need of face-lift to improve academic performance by students of all socio economic backgrounds.

Every dollar spent in a child is an investment in future.

Complete overhauling is required in areas like classroom size, materials including new Textbooks, enriched curriculum with emphasis in Math and Science, Music and Arts, Sports facilities, recruitment of qualified teaching staff, Teachers’ salary, training and professional development, new energy efficient buildings regardless of districts and zones in every state.

Undoubtedly, education must be a priority with K-12 system being the foundation for young minds entering the academic world. The reason United States is lagging behind in international standards is due to neglect of our school system particularly the early learning stage (K-12) when the opportunity to help every student thrive is available to educators.

Therefore, the state and the federal government are obligated to enhance achievements in educational programs through investments in the state-of-the-art educational system.

Similarly, health, housing, energy and environment are equally important as the taxpayers benefit from adequate health care, proper housing, affordable energy, clean and safe environment.

——————————————————————————————————————

Pragmatic Solutions:

The best option to reconcile California budget is to consider both tax increases and costs reduction as suggested by many analysts and experts on this issue.

According to the analysis by San Jose Mercury News, February 8, 2009

Budget spending outpaced inflation and state’s growth.

Interestingly, the social services and K-12 education received proportionately less funding as compared to the extra spending identified in Criminal Justice, health care and filling the gap for the reduced vehicle license fee in the analysis of actual spending in 2007-2008.

First, action is required to identify the revenue sources via tax increases.

1. Marginal increase in Sales Tax of goods and services including the sales on the cyberspace would provide an even tax distribution for the society.

2. Increasing Vehicle License fee for all is necessary to address the massive deficit. In this context, it is important to raise another explosive issue of undocumented workers in California without drivers’ license or vehicle registrations.

Issuing drivers license and allowing all undocumented workers to register their vehicles would not only generate income for the state, it would also strengthen state and national security with the documentation of all residents in the state.

Subsequently, acquiring vehicle insurance by the undocumented workers would minimize the burden on registered owners in addition to stimulating the economy through insurance industry.

At present any vehicle registration or insurance by undocumented workers carried out in a back alley manner depriving the state due proceeds.

3. Target items for tax increase to reduce health care costs such as tobacco, hard liquor products and items subject to possible health abuse.

4. In the establishment of social standards, tax increases on winnings through gambling and advertisement sales of pornography (assumed to be a multibillion dollar industry) is justified to make way for important social services and programs.

5. Review and revise taxation policy for California Corporations hoarding income in tax havens along with their offshore subsidiaries.

6. Airport tax, Port fees, dutiable goods, customs and excise duty are other sources of revenue.

7. Increase tax on entertainment industry to pay for education, kids welfare, community hospitals, colleges and institutions.

8. Specific environmental protection act by levying heavy penalties on environmental pollution (air, land and sea) through negligence such as oil spilling, carbon emissions and violation of aviation standards.

9. Marginal increase in gasoline tax would enable energy efficient programs such as solar, wind and hydro thermal power.

10. Last but not the least, leasing government land to corporations and scientific institutions, university laboratories or airline industry with enforcement of strict environmental regulations, not excluding sale of government assets no longer useful in the short or long run.

——————————————————————————————————————————————-

Costs Reduction:

Criminal Justice System:

A thorough examination of the Criminal Justice system is necessary from the analysis and news reports.

The State must devise a mechanism to reduce prison population through major social reforms at all levels beginning with the juvenile detention center.

Further, the parole system, three strikes law and other misdemeanor charges reassessed and offenders deployed in monitored community services rather than crowding prisons is the ideal strategy to cutback spending.

Health Care:

Healthy Approach to reducing health care costs –

Medicaid for senior citizens and economically disadvantaged population.

Promoting preventive care with immunizations.

Early diagnosis of diseases through annual or bi-annual medical checkups and

Subsidized prescription drugs through tax incentives to pharmaceutical and bio-tech industry are few possibilities to deal with health care crisis.

Counseling services and Therapy for psychological and other mental health problems as a preliminary screening process to ease the substantial costs in this regard.

General well being encouraged through active life combined with healthy diet in schools and other areas of the community.

Vehicle License Fee backfill – To be reinstated as outlined above.

General Government – Electronic record keeping and updating technology would considerably improve efficiency and prohibit excessive spending in administrative services.

Higher Education – Engagement in community development activities in return for student loans is a progressive cost recovery scheme.

Transportation – Cost savings methods and effective transportation means aimed at conservation of time and energy recommended for this expense.

Resources and environment – Best to follow guidelines suggested above for environment.

All other costs and spending not discussed or highlighted must be carefully reviewed and those proven redundant with no benefit to taxpayers or the State eliminated to reconcile the budget.

———————————————————————————————————————

Time for Action by California Legislators

Investment in better education and all of the essential services means building future with healthy, responsible and productive citizens as opposed to increasing prison population demanding major diversion of funding to criminal justice system.

There is an urgency to underscore the fact that not all taxpayers necessarily benefit and appreciate the frugal tax savings by preventing tax increases because such action favors the wealthy minority while leaving the majority marginalized in a society.

If the legislators really care for their constituents and the state/nation they pledge to serve, they need to pause and reflect on the realities of depriving majority of the population to decent lifestyle and economic prosperity, the predominant cause of the current sluggish consumer spending.

Often, provision of unemployment and social security benefits, Medicaid, health insurance, food stamps…dismissed as socialized enigma in a Capitalist economy. Unfortunately, a reminder is required that subscribers of these benefits and services ultimately contribute to the success of the capitalist system as consumers of various products and services.

As stated earlier in the blogpost titled Redistribution of Wealth, Oct 31, 2008, www.padminiarhant.com

Promoting economic status as highlighted above…

Eventually, create a fair system of sharing the economic burden by all rather than only by the affluent ones.

Such farsighted and permanent solutions are in direct contradiction to the myth and misnomer of the doctrine against short term tax increases essential to combat severe economic recession.

Socialism, Marxism may well be the nemesis to Capitalism,

Capitalism cannot thrive without consumerism – – That is the fact

California budget crisis must be resolved with no further delay.

It is time for legislators to set the priorities right to fit in with the new millennium goals.

Thank you.

Padmini Arhant

Reconciliation and Approval of Economic Recovery Plan

February 10, 2009

President Barack Obama’s candid appeal to Congress and Senate via press conference confirms the White House commitment to relieve severely hurting citizens from the agonizing pain of the ailing economy.

The legislators resisting compromise to the stimulus package obviously do not share the pain of their constituents. If they did, they would have no objection to essential and guaranteed investments specifically identified for job creation in President Obama’s plan.

It is frustrating that partisan politics remains a force to reckon with for the electorate in a democracy.

Tragically, ideology leads the way to oppose a bill designed to assist every taxpayer who is also the consumer and most importantly a voter from becoming a recipient of food stamps.

The excerpt from a recent article titled –

“Billions in aid to states cut amid struggle over stimulus”

By Associated Press, February 8, 2009.

“President Barack Obama and Senate Republicans bickered Saturday over his historically huge economic recovery plan after states and schools lost tens of billions of dollar in a late-night bargain to save it.

Forging compromise –

The compromise reached between a handful of GOP moderates led Susan Collins of Maine, the White House and its Senate allies stripped $108 billion in spending from Obama’s plan, including cutbacks in projects that likely would give the economy a quick lift, like $40 billion in aid to state governments for education and other programs.

Yet, it retained items that also probably won’t help the economy much, such as $650 million to help people without cable receive digital signals through their old-fashioned televisions or $1 billion to fix problems with the 2010 Census.

Among the most difficult cuts for the White House and its liberal allies to accept was the elimination of $40 billion in aid to states, money that economists say is a relatively efficient way to pump up the economy by preventing layoffs, cuts in services or tax increases.”

————————————————————————————————————————————–

Reality Check:

Now, any rational citizen regardless of party affiliation should ask the following questions to the GOP moderates seemingly endorsing the bill.

Where are the priorities?

Is helping people receive digital signals through their old-fashioned televisions and a staggering $1 billion to fix problems with the 2010 Census more important than investment in education, easing the burden on states to lift economy by preventing layoffs, cuts in services and tax increases?

Do GOP members realize the reason behind colossal defeat in the 2006 and 2008 election?

The American electorate is tired and bogged down with Washington’s immature revengeful tactics in the approval of legislative matters concerning the lives of every citizen.

Ironically, all those legislators against the approval of this bill targeting the future of our nation with respect to education, job creation and needful services forget that their jobs are also on the line in the process.

If they presume Capitol Hill to be a comfort zone for a specified period and expect immunity from the economic crises, they are being delusional as the electorate has choices to reject such representation in a democracy.

Where was the hype and concern when the previous administration committed the nation to a reckless war that has virtually bankrupted our economy?

Whatever happened to the various failed stimulus packages without any accountability to taxpayers or the oversight committee passed by the Bush administration and approved by the same legislators in opposition to the current one committed towards education and aid to states to revive the economy by preventing layoffs, cuts in services or tax increases?

The irresponsible conduct to block the bill simply suggests that come 2010 the democratic system would be better off with an alternative political party pledging support to the people and engage in constructive rather than destructive role in nation building.

Similar dilemma experienced in the State of California where the budget crisis has reached a point of no return due to political dogma upheld against pragmatic solutions.

The electorates are viewing the entire situation at both state and federal level and will deliver their decision in the ballot in less than eighteen months.

Despite presentation of this bill in the most cohesive manner, all those legislators on both sides prolonging the approval are not only jeopardizing the opportunity to help every constituent from economic failure but also their own career as an elected official to serve the people and the nation in crisis.

It is the duty of every public servant to recognize the plight of their population and heed to the call to oblige urgent needs by approving the stimulus bill particularly the aid to states that are broke along with education, jobs, services and tax modification.

There is no time for procrastination and all that is required is action. Unfortunately, the Presidency of Barack Obama with unprecedented transparency is subject to undue scrutiny for political strategies.

The campaign trail promises prior to election to office whether it is the House or Senate always remains a distant memory with "business as usual " demonstration upon becoming Senators or the House of Representatives.

——————————————————————————————————————–———————-

Decisive Action:

The economic recovery plan aimed at job creation, assistance to states sharing status quo of the nation, improvement of infrastructure and commitment to revival of education, energy, health care is the step in the right direction.

It is imperative for both Democrats and Republicans to get on board in a bipartisan effort and approve the bill without elimination of prudent investments mistaken for wasteful spending. The job losses in Indiana, near double-digit unemployment in California are real problems felt by hard working people across the nation.

The proposed bill with taxpayers’ dollars invested for taxpayers’ benefits is undergoing intensive criticism by lawmakers primarily responsible for allowing the previous administration to squander economic surplus along with exhaustion of national reserves and treasury in wild adventures as the signature mission of the Republican era.

President Barack Obama’s administration did not create this economic catastrophe. They have inherited it upon election to the office on January 20, 2009. Nevertheless, the rhetoric in the Senate and the House mocking hope and change in a theatrical manner is reflective of the opposition role to make noise, create roadblocks and exacerbate the crisis with an adversarial action or inaction.

Only if such fervor and excitement displayed during the approval of mass financial bailout worth a whopping $700 billion and the unlimited commitment of resources in an unnecessary war in Iraq by the Bush administration there would be no debate or discussion for any economic stimulus package today.

It is apparent from those legislators’ reluctance to acknowledge the realities that they prioritize their own needs to remain in power over their constituents’ hardships and suffering in a debilitating economy.

The electorates have a clear choice in the next election to remember those who care and reject those who abandon them during harsh crises.

Political parties might survive on rhetoric and empty promises but people cannot wait until political factions make up their mind for decisive action required to avert Armageddon upon failure to approve the authentic economic recovery plan by President Barack Obama.

Thank you.

Padmini Arhant

Senate Debate on Economic Recovery Plan

February 7, 2009

The Senate is engaged in vigorous debate over the economic stimulus package from President Barack Obama.

It appears there is massive confusion in the determination of priorities on this bill. The honorable Senators are concerned about the effectiveness of this bill given the magnitude and the urgency to address serious challenges facing our nation.

Individual viewpoints during debate are healthy and sometimes serve the purpose to remain objective.

However, in this particular process overindulgence could lead to distraction and become counter-productive.

After viewing the Senate discussion of the bill, it is apparent that Senators are yet to configure the policies and programs to achieve the pertinent goals.

For instance, there is mix up between creating jobs and dealing with foreclosures. In order to target the specifics of the current economic recession, let us breakdown the various components in requirement of stimulus and revival.

The consensus is to have a stimulus plan that yields the desired result of averting further economic meltdown by setting the pace for recovery.

As stated earlier in the economic recovery plan posted on February 3, 2009 the culminating factors of the economic crises are;

Housing market, Job market and Stock market.

Housing market – It is important that foreclosures are dealt with effectively and refinancing opportunities made available to homeowners in dire state.

Current plan has $15,000 in tax credits for new homebuyers in an effort to improve the housing prices through home sales. Unless and until the existing homeowners rescued from losing homes through foreclosures and others with affordable mortgage payments to adjust the deficiency in home value, any measures in this sector will be futile.

At the same time, an amendment to the debated stimulus bill to handle foreclosures saving approximately 1.5 million families from this crisis is a repetitive exercise as claimed by those Senators in opposition to this amendment.

The reason being, as articulated by the Senators against the amendment, The Troubled Assets Relief Program (TARP) worth $700 billion was committed for this purpose along with bailout of financial institutions.

Accordingly, $50 billion was allocated towards foreclosures and restructuring of mortgage programs.

Therefore, it is imperative to derive that $50 billion from the previous TARP fund and apply towards the revival of housing market crisis. It is quite possible that $50 billion will not be adequate to provide instant relief but action recommended than inaction.

More reason to verify the exact distribution of the previous TARP fund i.e. $700 billion bailout and redirect any unused portion towards challenges such as housing market and consumer spending.

————————————————————————————————-

Objectives of the Stimulus/Recovery Plan:

The primary focus of the current stimulus package must be job creation, aid consumer spending and investments with safe returns.

Job creation: President Barack Obama’s proposal aims for creation of 3 million jobs through various avenues such as —

Direct investments in public works projects i.e. repair and reconstruction of infrastructure across the nation.

Tax incentives and financial assistance to small businesses and corporations with limited resources.

Minimize payroll tax to curb mass layoffs.

Restore manufacturing jobs with necessary financial assistance and modified tax structure.

Consumer spending: The stimulus package offers relief to consumers with tax credit of $500 for individuals and $1000 for couples. It is essential for consumers to utilize the credits towards consumption of goods and services rather than reducing personal debts as again that would be beneficial to the financial institutions, the major contributor of the economic recession.

It is worth remembering that the Bush administration experimented with this stimulus strategy last summer, i.e. 2008 with $300 rebate per child and a cap on annual income of the family. Obviously, the trial and error method did not payoff due to neglect of other crisis like housing, stock and financial markets.

The lesson learned is to treat housing, job, financial and stock market crisis individually and isolate them from one another even though they comprise the entire cause of the economic recession.

Other ways to trigger consumer spending is to ease the burden on families with energy costs i.e. heating homes around this time of the year is significantly high and reduction of surcharges and taxes on the energy bill will provide relief to population in the worst affected regions of the country.

Consumers represented across the social and economic spectrum in a society range from youth population to families, senior citizens and self-employed individuals…

Any tax benefits and financial assistance should be inclusive of all potential consumers to obtain maximum gains.

Investments with safe returns: All investments must produce optimum returns, secured with viable collaterals and subject to rigorous oversight. Most importantly, the investment must generate jobs and/or income for taxpayers as well as create opportunities to tackle other issues like health care, energy and education.

—————————————————————————————————————–

Partisan Politics vs. National Interest

It is common knowledge that the two major political parties have unique positions on fiscal policies.

The Republican Party is vehemently opposed to tax increases to reaffirm the political platform of the party, while scouring for wasteful spending.

Fiscal responsibility is necessary for a nation saddled with alarming deficit. Nevertheless, desperate times call for desperate measures. Now is the moment to rescue the nation with prudent investments and techniques to revitalize growth in all sectors.

During elimination of costs proven liabilities, diligence is required from legislators to distinguish investments from wasteful spending. Funding National Endowment for Arts is a worthy cause as it promotes creative and Performing arts besides employment opportunities for a significant population who are ultimately taxpayers in the economy.

Sometimes, political debates overshadow the ambition to resolve major national crises.

The Democratic Party must be committed towards immediate mission to revive the economy and therefore abstain from elaborate spending spree on frivolous projects that form the basis for unnecessary political debates.

Compromise on both sides by finding common ground to restore consumer and investor confidence is vital for economic recovery.

With mass layoffs, collapse of housing, financial and manufacturing sectors… partisan politics is symbolic of Washington and it is time to get past conventional ways to demonstrate that representatives in the House and Senate care for their constituents, the real victims of the economic catastrophe.

Conciliatory effort and collective action from all sides is what required to helping our nation survive the worst economic period in recent times.

The Senators can confirm their willingness to work together for national interest by approving the President’s recovery plan.

Taxpayers as electorate are viewing the situation with the hope that policy makers will put aside their differences and reject political scores by pledging support to the job creation proposal from President Barack Obama.

Thank you.

Padmini Arhant

Economic Recovery Plan (ERP)

February 3, 2009

It is obvious from the headlines and news editorials across the nation that the economy is in deep recession.

San Jose Mercury News January 31, 2009 – Thank you.

GDP plunges at 3.8%, worst slide in quarter century

Autos – Valley car sales hit 15-year low – and 2009 looks worse

Wall Street – Worst January ever as Dow drops 8.8% this month

Washington – bruising battle over stimulus, Obama acts to bolster labor

Mortgage crisis spreading to affluent areas.

Meanwhile – Exxon Mobil sets U.S. record; $45.2 billion annual profit.

World Economic Forum in Davos, Switzerland concludes that the world is dealing with financial crisis with no solutions.

——————————————————————————————————————–

Optimistic View

Despite such gloom and doom, there is light at the end of the tunnel.

A thorough review and analysis of the problems that primarily contributed to the current economic crisis is essential in understanding the fundamental cause of the present economic recession.

Then addressing each issue on priority basis including the failure of various stimulus packages by the previous administration must be an integral part of the remedial measures for the economic recovery.

It is common knowledge that the origin of the current recession stems from various sources,

1. Subprime mortgage crisis contributed to housing market decline.

2. The major components attributing to the decline in housing prices are foreclosures due to default homeowners and delinquencies in mortgage payments.

3. Financial institutions holding high-risk mortgage backed securities sought bailout of their insolvency with taxpayers’ generosity.

4. Banks and other financial institutions decided to stranglehold the credit market leading to liquidity freeze with an adverse effect on consumer based industry represented by small businesses, retail outlets, medium corporations and homeowners alike.

5. Small businesses, Retail industry and medium corporations as the foundations of the economic infrastructure could not survive or sustain growth in the absence of credit facilities blocked by the financial institutions.

6. As stated earlier on numerous occasions, the collapse of small businesses, retail industry and medium corporations have a domino effect on wholesale manufacturers ultimately owned by major corporations in any industry.

7. Hence, the layoffs triggered from the bottom of the economic pyramid spread across the aisle and all the way to the top affecting emerging and viable corporations in many sectors.

8. As a result, the unemployment rate went soaring up to 7.8% with most states reporting double digit in this respect.

9. The credit crunch combined with housing market crisis significantly hurt investor confidence and led to the selling frenzy of stocks and investments by short term and new investors in the stock market. In addition, the current static in the credit market and the general economy has forced average consumers to live off their investments and savings.

10. Despite, capital infusion through bailouts and consistent productivity by all industries, the dismal stock market performance is related to poor earnings from the sluggish consumer spending in the competitive market and globalized economy.

Therefore, Consumer spending is the catalyst for revival of the job sector and corporate growth with desired earnings eventually reflecting in the stock market performance.

———————————————————————————————————————

Primary Cause and Effect

Housing market crisis – Decline in housing prices due to Foreclosures, Delinquency in Mortgage Payments with no refinancing opportunities.

Liquidity freeze or Credit Crunch – Small businesses, Retail industry and Medium Corporations deprived of cash flow by banks and financial institutions declared bankruptcy and subsequently the manufacturing sectors as well as the large Corporations producing mass layoffs.

Inadequate Consumer spending – Because of rising unemployment and scarce financial resources with no access to home equity other than dwindling investments in savings and stock holdings.

Lack of Accountability and Transparency from previous bailouts – Wall Street bailout of $700 billion have not been followed through with Corporate executives rewarding themselves to a tune of $20 billion in extravagant bonuses and perks.

Inaction and dormant role by the Congressional Oversight Committee set up for overseeing the purpose of bailout i.e. activate lending to the deserving and qualified business sectors and homeowners has further exacerbated the credit crunch.

Alarming Deficit – Multi-trillion dollar deficit accumulated by the previous administration from excessive borrowings predominantly from China, Saudi Arabia and Japan precipitously diminished the dollar value in the international market.

GDP plunges because of trade imbalances and culmination of all of the above factors in the domestic front of the frail economy.

Financial Commitments – Funding two major wars in Iraq and Afghanistan exhausted the national treasury and reserves besides overshadowing the onset of economic recession at home.

Wasteful Spending – Some legislators’ penchant for pet projects aka pork barrel spending or earmarks to oblige excessive lobbying from campaign donors led to misappropriation of budget replacing funding for essential services benefiting children, disabled and mentally ill patients, senior citizens, veterans, youth population, retirees and all those at the bottom of the socio economic strata.

Ironically, budget is vigorously debated over matters that are counter-productive while ignoring the myopic view of issues…

Universal health care

Energy efficient programs

Overhauling of educational system particularly public schools, state and community colleges through adequate funding.

Effective environmental policies.

Investments in science and technology to advance research and development in the areas of stem cells, regenerative medicine and Genomics.

Creative Arts and learning with a broad perspective of cultural exchanges between nations.

Space exploration in search of knowledge and facts for humanitarian cause.

Channeling appropriation of funds towards Peace Corps to promote peace and diplomacy for national security as opposed to defense spending and proliferation of nuclear technology.

Veteran Affairs involving care and rehabilitation of combat forces during and post war period as well as extending housing, education and health care for their dependents.

Expansion of Sports and recreational activities for public schools and communities through federal funding to States as a measure to keep health care costs down.

An elaborate version will be presented on what federal and state governments can do for the citizens who are taxpayers, consumers and most importantly electorate in a democracy.

———————————————————————————————————————

Time for Action – Effective Strategies

Since the cause of the economic crises have been identified, it is time to address the problems with effective solutions i.e. strategies.

The nation desperately needs relief from the burgeoning crises:

Housing market crisis – Immediate measures required with a moratorium on foreclosures for two years supplemented with refinancing for default and delinquent mortgagees at the existing market rate or lower to adjust the deficiency in home value.

Liquidity Crisis or Credit Crunch – It is incumbent on the Treasury Secretary Timothy Geithner and the Federal Reserve Chairman Ben Bernanke along with Congress and the Congressional Oversight Committee to hold Wall Street accountable for the $700 billion taxpayers’ funds and demand they facilitate liquidity and honor the commitment to the taxpayers.

Failure to comply with the requirement should have implications such as sale of all those beneficiaries’ assets and financial instruments withheld as collateral during borrowing assuming the previous administration adhered to the regular lending practices particularly a bailout of this magnitude.

Corporations and legislators alike must be held accountable for their actions and inactions to demonstrate that no one is held above the law in the land of republic.

Consumer Spending – President Barack Obama’s economic stimulus package for $819 billion passed by Congress and now the proposed package worth $867 billion for Senate approval deserves attention and action.

As discussed above, consumer spending is vital and instrumental to stimulate economy.

Again, consumers as victims of mass layoffs, debilitating job market, volatile stock market, and declining housing market have nothing to rely upon for income normally used in purchase of goods and services.

The cash strapped economy has evolved into a stagnant quagmire with disastrous consequences. It is imperative to relieve the economy with necessary tools that are contained in President Obama’s stimulus package.

President Barack Obama has unveiled the American Recovery and Reinvestment Act to revive the economy by easing the burden on consumers with debts, failing small businesses as well as Corporations in requirement of capital investment.

President Barack Obama during his weekly radio address acknowledged the urgency to get credit flowing again to families and businesses. The President further promised to help lower mortgage costs and extend loans to small businesses so they can create jobs.

The administration, the president said, would ensure that chief executives “are not draining funds that should be advancing our recovery,” and the assistance to the financial system would be accompanied by “unprecedented transparency, rigorous oversight and clear accountability, so taxpayers know how their money is being spent and whether it is achieving results.”

The President was empathetic towards homeowners, students and small businesses in need of loans but left to fend on their own while Banks have been extended a hand with a bailout.

There is obviously a stark contrast in the objectives between the stimulus package of last year and the current one by President Barack Obama.

According to an article by New York Times on this issue – “The previous administration’s The Troubled Asset Relief Program (TARP) was supposed to be used up to buy the banks’ troubled mortgage-related assets. But, the Bush administration’s Treasury Department shifted gears, using the program instead to shore up the banks by injecting them with capital.

But instead of being inspired to lend more, too many banks hoarded their new capital, critics of the financial industry say.”

President Obama is seriously committed towards alleviating the suffering of ordinary citizens with necessary tax breaks of $500 for individuals and $1000 per family and tax incentives to small businesses including corporations with limited resources.

The Obama administration’s economic stimulus package has specific targets to bolster the economy and welcome sharing of public concerns on issues related to jobs, business, mortgage situation…

Since the commencement of his Presidency, the President has pledged support for the victims of the worst economic crisis. It is apparent from the actions taken within short period of the President assuming office.

The new millennium has brought series of disasters on our nation with the economy hitting rock bottom. There are undeniable challenges ahead and it requires the entire nation to come together in resolving every crisis.

Even though, a new President was elected on the message of hope and change , it is the responsibility of every citizen and particularly the legislators as representatives of their constituents to act immediately in the approval of the proposed stimulus package.

Any procrastination will only lead to further deterioration of the worsening economy. It is not the time for partisan politics as the stakes are high with too many unfortunate events unfolding as time goes by.

The victims are none other than the electorate entrusting power to their legislators for action on normalization of job, stock and housing market.

——————————————————————————————————————–

Summary of Economic Recovery Plan

President Barack Obama’s stimulus package is essential to revive consumer spending, housing market, job market and corporate growth directly influencing stock market performance.

It is important to ensure that pork barrel spending does not find its way in this stimulus package during deliberation by reluctant policymakers.

Economic recovery is inevitable with discipline, determination and drive –

To eliminate or minimize costs proven liabilities.

Strategic planning and monitoring through rigorous oversight.

Implementation of effective policies with guaranteed results.

Targeting problems with efficient programs.

Restoration and preservation of jobs through investments benefiting the workforce.

Reviewing tax structures to create incentives for business sectors dealing with liquidity crisis.

At the same time closing any gaps or loopholes for tax evasions by corporations and legislators.

Relieving homeowners with appropriate measures as suggested above.

Reform of institutions lacking in ethics and moral conduct.

Enforcement of law and order with consequences for non-compliance regardless of hierarchy.

Conscientious effort to reduce deficit by restraining overseas borrowing and commitment towards domestic economic growth within a specified timeframe.

Pursuit of common goals and objectives via collective action is important reflecting every individual’s desire to succeed in all endeavors.

Our nation provided opportunities, prosperity and happiness during economic boom and now it is the moment for all citizens to collaborate and help our newly elected President Barack Obama execute the tasks required for speedy economic recovery.

The fate of our nation is hanging in balance from the monumental crises and legislators in the Senate have an awesome responsibility to move forward and approve the economic stimulus package proposed by President Barack Obama to avert more calamities.

Thank you.

Padmini Arhant

PadminiArhant.com

PadminiArhant.com